Hire the Top 2% of

Remote Credit Scoring Models Developers

in India

Your trusted source for top remote Credit scoring models developers — Perfect for startups and enterprises.

Freelance contractors Full-time roles Global teams

129 top Credit scoring models developers available to hire:

Credit scoring models developer in India (UTC+6)

Risk analyst with 6+ years of experience in various risk including credit risk, IFRS9, scorecard development, statistical modeling, climate risk, operational risk. I can use technologies such as R, Python proficiently. I have also knowledge of SAS, SQL, Tableau. I have experience in developing web applications using R shiny. Well-versed in visualization using R, Python, Rmarkdown reporting, report automation.

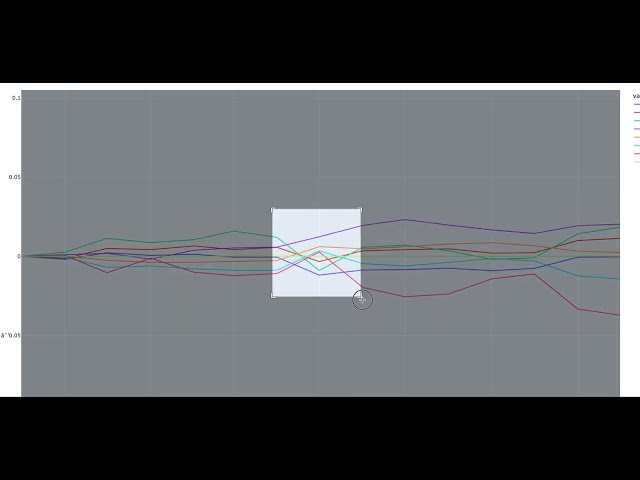

Vetted Credit scoring models developer in India (UTC+6)

Highly experienced Full-Stack Data Scientist / Machine Learning Engineer and Software Developer, delivering production ready ML models and customised softwares to automate business processes and decision making. With an added advantage of attaining MBA from India's finest B-school, I build tech powered solutions to ensure maximum profitability for any business venture. Skills : ● Data Science & Machine Learning : Supervised ML, Linear Regression, Decision Tree, Prompt Engineering, Hypothesis Testing, Statistics, Exploratory Data Analysis, Data Wrangling, Cleaning & Tidying, Feature Engineering, Data Visualization, SQL, Scikit-learn, NumPy, Pandas, Matplotlib, Plotly, Dash, Microsoft Excel, Metabase, AWS Athena & Sagemaker, Google BigQuery, Unsupervised ML, Neural Nets, NLP, Large Language Models (LLM), GPT, Text Embedding, Vector Databases, PyTorch, fastai, TensorFlow, OpenAI API, Generative AI (GenAI) ● Programming : Python, MySQL, PostgreSQL, HTML, CSS, Flask, Heroku, APIs, Git, AWS S3 & EC2, JavaScript, jQuery, Java, Werkzeug WSGI, Leaflet.js, Folium, GeoPandas, Google Maps API & Sheets API, Bootstrap Professional Work : 1. Engineered a suite of cutting-edge ensemble ML models, revolutionizing underwriting processes for personal loan products a major FinTech Lender in India. 2. Developed and deployed 6 ML models for credit-risk scorecard, using 5 data sources (Bureau, Bank Statement, SMS, Smartphone App Info and Demography), improving risk spread by 1200%. 3. Devised NLP based models (Passive Aggressive Classifier and XGBoost Classifier with TFiDF Vectorizer) for classification of SMS, improving recall by 35% and accuracy by 60%, and saved 36 man-hours daily, processing over 200 Mn SMS/day. 4. Created LLM based classifier models using Prompt Engineering on ChatGPT (OpenAI), Mistral AI (Open Source) and other open source models. Deployed using AWS Sagemaker. 5. Crafted an LLM based Law ChatBot that answers to Lawyer's questions pertaining to any specified PDF file of a Legal Document. 6. Built an in-house MLOps infrastructure with AWS Sagemaker, enhancing model integration. 7. Engineered 330+ features from SMS data to emulate metrics including cash flow, lifestyle and financial literacy indicators. Included steps like Exploratory Data Analysis, Data Wrangling, Cleaning & Tidying, Feature Engineering. 8. Designed comprehensive daily and monthly model monitoring dashboards using Flask-Python, Metabase and SQL tables, improved response time to anomalies by 75%, enhancing overall model reliability and performance. 9. Designed a Customer Loyalty Program and delivered via a web and Android app, over 2500 DAU, rated 4.6 on play store for a manufacturer and distributor of PVC Plumbing Systems in Central India. 10. Increased territorial penetration by over 25% by building automated interactive GIS sales dashboard for a wholesale business in India. 11. Achieved 100% monthly revenue target completion by creating Business Intelligence Dashboard – Google Apps Script. 12. Reduced total credit by 20% in five months by building a Python-bot that sends regular WhatsApp messages to debtors. 13. Saved annual recurring cost of ₹25 lakh+ by automating data collection for a hedge fund using Yahoo Finance API & Python. 14. Cut time from over 4 hours to 2 clicks by developing a GIS-enabled web application for new-license territory discovery for a developer and licensor of Escape Room Game Designs in USA. Personal Projects : 1. Developed a Fake News Classifier using TfIdf Vectorizer and Passive Aggressive Classifier - ML, pandas, scikit-learn. 2. Created a Spam Email Classifier using Naïve Bayes and XGBoost Classifiers - ML, NumPy, seaborn. 3. Designed a Cat Image Classifier using multi-layer neural network - DL, NumPy, Matplotlib, h5py, PIL, SciPy. 4. Developed a web app to manage portfolio of stock with real-time prices using IEX API -SQLite, Flask, HTML, CSS, JS. 5. Built a terminal-run card game called Declare - Python. Education : Computer Science and Data Science Masters (Self-Learned) Major Electives: Computer Science: MIT 6.0001, MIT 6.0002, Automate the Boring Stuff with Python, Harvard CS50, Harvard CS50 - Web Development, Intro. to Algorithms, Design and Analysis of Algorithms, Software Development Lifecycle, GIT and GitHub, Flask for Python, The Python Mega Course, Data Structures, Analysis of Algorithms, The Odin Project etc. Data Science: Stanford CS229, Stanford Machine Learning (CS229A), Data Science path on Codecademy.com, Data Science and Machine Learning Bootcamp, Neural Networks and Deep Learning, Deep Learning with PyTorch: Zero to GANs, Improving Deep Neural Networks: Hyperparameter tuning, Regularization and Optimization

Vetted Credit scoring models developer in India (UTC+6)

Hello, Hope you are well. I have an overall experience of 7+ years mostly in Financial industry solving business problems using data. I have experience in Data Science, Data Engineering and Analytics. Currently i am working with Goldman Sachs, previously i have worked with American Express, Fractal Analytics and Infosys.

Vetted Credit scoring models developer in India (UTC+6)

I'm a dedicated full-time mentor, consultant and Lead software developer with a track record of over 1000+ sessions since 2016. Having 9 years of programming experience in Python, java, GoLang, AWS, MongoDb, ElasticSearch, telethon and many more technologies. I'm passionate about problem-solving and navigating intricate code bases. I love working with: ⭐ Python ⭐ Java ⭐ Spring ⭐ NodeJS ⭐ AWS ⭐ SQL ⭐ MongoDB ⭐ ElasticSearch ⭐ React ⭐ GoLang WHAT SEPARATES ME FROM OTHERS? * Strong and clear communication * Availability at all times * 100% refund incase of non satisfactory session Achievements: * 1000+ Sessions * All 5 star rating

Vetted Credit scoring models developer in India (UTC-8)

**I’ll help you build systems that mimic human intelligence.** Expert in building End to end AI/ML Applications.

Vetted Credit scoring models developer in India (UTC-8)

I am a Senior AI Engineer with expertise in Python, ML, and Generative AI looking for a Dynamic workplace with a lot of work involving interesting and challenging problems.

Vetted Credit scoring models developer in India (UTC+6)

As a Generative AI Engineer, I am responsible for developing, designing, and maintaining cutting-edge AI-based systems to ensure smooth and engaging user experiences. My role involves creating and developing generative models that have the ability to generate new content, such as images, text, and audio, based on patterns. I work across client teams to develop and architect Generative AI solutions using machine learning and other AI technologies. Additionally, I participate in activities which includes refining and optimizing prompts to improve the outcome of Large Language Models (LLMs). I also evaluate and select appropriate AI tools and machine learning models for tasks, as well as build and train working versions of those models using Python and other open-source technologies.

Vetted Credit scoring models developer in India (UTC-8)

Results driven professional with 8 years’ experience in driving critical business outcomes through data driven recommendations and business strategies. Expertise and knowledge of executing business problems using data, developing models using ML and NLP for text data, interpreting results. Experience in using SQL to deep dive into datasets for actionable business insights. Proficient in Python for data collection, data wrangling, data analysis, model development and deployment and Expertise in Data Visualization using Tableau and Looker. Exploring GENAI for practical applications with a focus on leveraging Large Language Models (LLMs) within the AWS Bedrock environment

Vetted Credit scoring models developer in India (UTC-7)

I am a Genai researcher at Monotype, specializing in generative models,NLP, and recommender systems. I have experience in ML engineering, research, and development across various industries.

Vetted Credit scoring models developer in India (UTC+6)

I am a Senior Software Engineer with expertise in Python, Machine Learning, and AI. I have developed AI chatbots, customer support agents, and predictive ML models for network operations. My educational background includes a Master's in Software Systems with a Data Analytics specialization.

Discover more freelance Credit scoring models developers today

Why choose Arc to hire Credit scoring models developers

Access vetted talent

Meet Credit scoring models developers who are fully vetted for domain expertise and English fluency.

View matches in seconds

Stop reviewing 100s of resumes. View Credit scoring models developers instantly with HireAI.

Save with global hires

Get access to 450,000 talent in 190 countries, saving up to 58% vs traditional hiring.

Get real human support

Feel confident hiring Credit scoring models developers with hands-on help from our team of expert recruiters.

Why clients hire Credit scoring models developers with Arc

How to use Arc

1. Tell us your needs

Share with us your goals, budget, job details, and location preferences.

2. Meet top Credit scoring models developers

Connect directly with your best matches, fully vetted and highly responsive.

3. Hire Credit scoring models developers

Decide who to hire, and we'll take care of the rest. Enjoy peace of mind with secure freelancer payments and compliant global hires via trusted EOR partners.

Hire Top Remote

Credit scoring models developers

in India

Arc talent

around the world

Arc Credit scoring models developers

in India

Ready to hire your ideal Credit scoring models developers?

Get startedHire top software developers in India with Arc

Arc offers pre-vetted remote software developers skilled in every programming language, framework, and technology.

Look through our popular remote developer specializations below.

Build your team of Credit scoring models developers anywhere

Arc helps you build your team with our network of full-time and freelance Credit scoring models developers worldwide.

We assist you in assembling your ideal team of programmers in your preferred location and timezone.

FAQs

Why hire a Credit scoring models developer?

In today’s world, most companies have code-based needs that require developers to help build and maintain. For instance, if your business has a website or an app, you’ll need to keep it updated to ensure you continue to provide positive user experiences. At times, you may even need to revamp your website or app. This is where hiring a developer becomes crucial.

Depending on the stage and scale of your product and services, you may need to hire a Credit scoring models developer, multiple engineers, or even a full remote developer team to help keep your business running. If you’re a startup or a company running a website, your product will likely grow out of its original skeletal structure. Hiring full-time remote Credit scoring models developers can help keep your website up-to-date.

How do I hire Credit scoring models developers?

To hire a Credit scoring models developer, you need to go through a hiring process of defining your needs, posting a job description, screening resumes, conducting interviews, testing candidates’ skills, checking references, and making an offer.

Arc offers three services to help you hire Credit scoring models developers effectively and efficiently. Hire full-time Credit scoring models developers from a vetted candidates pool, with new options every two weeks, and pay through prepaid packages or per hire. Alternatively, hire the top 2.3% of expert freelance Credit scoring models developers in 72 hours, with weekly payments.

If you’re not ready to commit to the paid plans, our free job posting service is for you. By posting your job on Arc, you can reach up to 450,000 developers around the world. With that said, the free plan will not give you access to pre-vetted Credit scoring models developers.

Furthermore, we’ve partnered with compliance and payroll platforms Deel and Remote to make paperwork and hiring across borders easier. This way, you can focus on finding the right Credit scoring models developers for your company, and let Arc handle the logistics.

Where do I hire the best remote Credit scoring models developers?

There are two types of platforms you can hire Credit scoring models developers from: general and niche marketplaces. General platforms like Upwork, Fiverr, and Gigster offer a variety of non-vetted talents unlimited to developers. While you can find Credit scoring models developers on general platforms, top tech talents generally avoid general marketplaces in order to escape bidding wars.

If you’re looking to hire the best remote Credit scoring models developers, consider niche platforms like Arc that naturally attract and carefully vet their Credit scoring models developers for hire. This way, you’ll save time and related hiring costs by only interviewing the most suitable remote Credit scoring models developers.

Some factors to consider when you hire Credit scoring models developers include the platform’s specialty, developer’s geographical location, and the service’s customer support. Depending on your hiring budget, you may also want to compare the pricing and fee structure.

Make sure to list out all of the important factors when you compare and decide on which remote developer job board and platform to use to find Credit scoring models developers for hire.

How do I write a Credit scoring models developer job description?

Writing a good Credit scoring models developer job description is crucial in helping you hire Credit scoring models developers that your company needs. A job description’s key elements include a clear job title, a brief company overview, a summary of the role, the required duties and responsibilities, and necessary and preferred experience. To attract top talent, it's also helpful to list other perks and benefits, such as flexible hours and health coverage.

Crafting a compelling job title is critical as it's the first thing that job seekers see. It should offer enough information to grab their attention and include details on the seniority level, type, and area or sub-field of the position.

Your company description should succinctly outline what makes your company unique to compete with other potential employers. The role summary for your remote Credit scoring models developer should be concise and read like an elevator pitch for the position, while the duties and responsibilities should be outlined using bullet points that cover daily activities, tech stacks, tools, and processes used.

For a comprehensive guide on how to write an attractive job description to help you hire Credit scoring models developers, read our Software Engineer Job Description Guide & Templates.

What skills should I look for in a Credit scoring models developer?

The top five technical skills Credit scoring models developers should possess include proficiency in programming languages, understanding data structures and algorithms, experience with databases, familiarity with version control systems, and knowledge of software testing and debugging.

Meanwhile, the top five soft skills are communication, problem-solving, time management, attention to detail, and adaptability. Effective communication is essential for coordinating with clients and team members, while problem-solving skills enable Credit scoring models developers to analyze issues and come up with effective solutions. Time management skills are important to ensure projects are completed on schedule, while attention to detail helps to catch and correct issues before they become bigger problems. Finally, adaptability is crucial for Credit scoring models developers to keep up with evolving technology and requirements.

What kinds of Credit scoring models developers are available for hire through Arc?

You can find a variety of Credit scoring models developers for hire on Arc! At Arc, you can hire on a freelance, full-time, part-time, or contract-to-hire basis. For freelance Credit scoring models developers, Arc matches you with the right senior developer in roughly 72 hours. As for full-time remote Credit scoring models developers for hire, you can expect to make a successful hire in 14 days. To extend a freelance engagement to a full-time hire, a contract-to-hire fee will apply.

In addition to a variety of engagement types, Arc also offers a wide range of developers located in different geographical locations, such as Latin America and Eastern Europe. Depending on your needs, Arc offers a global network of skilled software engineers in various different time zones and countries for you to choose from.

Lastly, our remote-ready Credit scoring models developers for hire are all mid-level and senior-level professionals. They are ready to start coding straight away, anytime, anywhere.

Why is Arc the best choice for hiring Credit scoring models developers?

Arc is trusted by hundreds of startups and tech companies around the world, and we’ve matched thousands of skilled Credit scoring models developers with both freelance and full-time jobs. We’ve successfully helped Silicon Valley startups and larger tech companies like Spotify and Automattic hire Credit scoring models developers.

Every Credit scoring models developer for hire in our network goes through a vetting process to verify their communication abilities, remote work readiness, and technical skills. Additionally, HireAI, our GPT-4-powered AI recruiter, enables you to get instant candidate matches without searching and screening.

Not only can you expect to find the most qualified Credit scoring models developer on Arc, but you can also count on your account manager and the support team to make each hire a success. Enjoy a streamlined hiring experience with Arc, where we provide you with the developer you need, and take care of the logistics so you don’t need to.

How does Arc vet a Credit scoring models developer's skills?

Arc has a rigorous and transparent vetting process for all types of developers. To become a vetted Credit scoring models developer for hire on Arc, developers must pass a profile screening, complete a behavioral interview, and pass a technical interview or pair programming.

While Arc has a strict vetting process for its verified Credit scoring models developers, if you’re using Arc’s free job posting plan, you will only have access to non-vetted developers. If you’re using Arc to hire Credit scoring models developers, you can rest assured that all remote Credit scoring models developers have been thoroughly vetted for the high-caliber communication and technical skills you need in a successful hire.

How long does it take to find Credit scoring models developers on Arc?

Arc pre-screens all of our remote Credit scoring models developers before we present them to you. As such, all the remote Credit scoring models developers you see on your Arc dashboard are interview-ready candidates who make up the top 2% of applicants who pass our technical and communication assessment. You can expect the interview process to happen within days of posting your jobs to 450,000 candidates. You can also expect to hire a freelance Credit scoring models developer in 72 hours, or find a full-time Credit scoring models developer that fits your company’s needs in 14 days.

Here’s a quote from Philip, the Director of Engineering at Chegg:

“The biggest advantage and benefit of working with Arc is the tremendous reduction in time spent sourcing quality candidates. We’re able to identify the talent in a matter of days.”

Find out more about how Arc successfully helped our partners in hiring remote Credit scoring models developers.

How much does a freelance Credit scoring models developer charge per hour?

Depending on the freelance developer job board you use, freelance remote Credit scoring models developers' hourly rates can vary drastically. For instance, if you're looking on general marketplaces like Upwork and Fiverr, you can find Credit scoring models developers for hire at as low as $10 per hour. However, high-quality freelance developers often avoid general freelance platforms like Fiverr to avoid the bidding wars.

When you hire Credit scoring models developers through Arc, they typically charge between $60-100+/hour (USD). To get a better understanding of contract costs, check out our freelance developer rate explorer.

How much does it cost to hire a full time Credit scoring models developer?

According to the U.S. Bureau of Labor Statistics, the medium annual wage for software developers in the U.S. was $120,730 in May 2021. What this amounts to is around $70-100 per hour. Note that this does not include the direct cost of hiring, which totals to about $4000 per new recruit, according to Glassdoor.

Your remote Credit scoring models developer’s annual salary may differ dramatically depending on their years of experience, related technical skills, education, and country of residence. For instance, if the developer is located in Eastern Europe or Latin America, the hourly rate for developers will be around $75-95 per hour.

For more frequently asked questions on hiring Credit scoring models developers, check out our FAQs page.