As more companies embrace remote work, efficient management of freelance payments has become easier than ever. Whether you run a startup or manage hiring at a larger tech company, deciding how to pay freelancers can be tough.

This guide provides a comprehensive overview and comparison of popular freelancer payment methods to help you choose the best option. Selecting the right payment method can streamline your operations and help build trust with your freelancers.

You can also try Arc, your shortcut to the world’s best remote talent:

⚡️ Access 350,000 top developers, designers, and marketers

⚡️ Vetted and ready to interview

⚡️ Freelance or full-time

Try Arc and hire top talent now →

Understanding Your Needs

Every company will have different considerations before choosing how to pay freelancers. The first step toward choosing the right freelancer payment method is assessing your business needs. Here’s a quick checklist to help you:

- Frequency of Payments: Do you need to make payments weekly or bi-weekly, or on a project-to-project basis?

- Volume of Payments: How many freelancers are you managing — is it a large team or just a few freelancers?

- Geographical Location: Are your freelancers based locally or internationally?

- Currency Exchange: Do you need to handle payments in multiple currencies?

With this checklist, you’ll be able to find the specific requirements that can direct your search for the best methods of freelancer payments.

Understanding Worker Classification: Independent Contractors vs. Employees

Before delving into payment methods, you must understand the differences between independent contractors and employees. This classification significantly affects payment processes and tax responsibilities.

Key Differences and Implications

Independent contractors are self-employed individuals who offer services under a contract for a specific task or project. They can set their hours and choose how and where they work. They are also responsible for their equipment and tools.

Employees work under the control and direction of their employer. This employer sets their hours — full-time or part-time — as well as their work location — remote or in the office. Employers typically provide the equipment and tools employees need to complete their daily tasks.

Tax Implications

Tax implications for each worker type vary depending on the individual’s location. For example, in the United States, independent contractors must file their taxes using a 1099 form, whereas employees must use a W2 form.

Proper classification is essential as it affects legal responsibilities and tax considerations. Misclassification can lead to significant legal penalties. At the time of payment, make sure whether the worker should be paid as a freelancer, an independent contractor, or an employee.

Read more: How to Do Taxes When Hiring a Freelancer

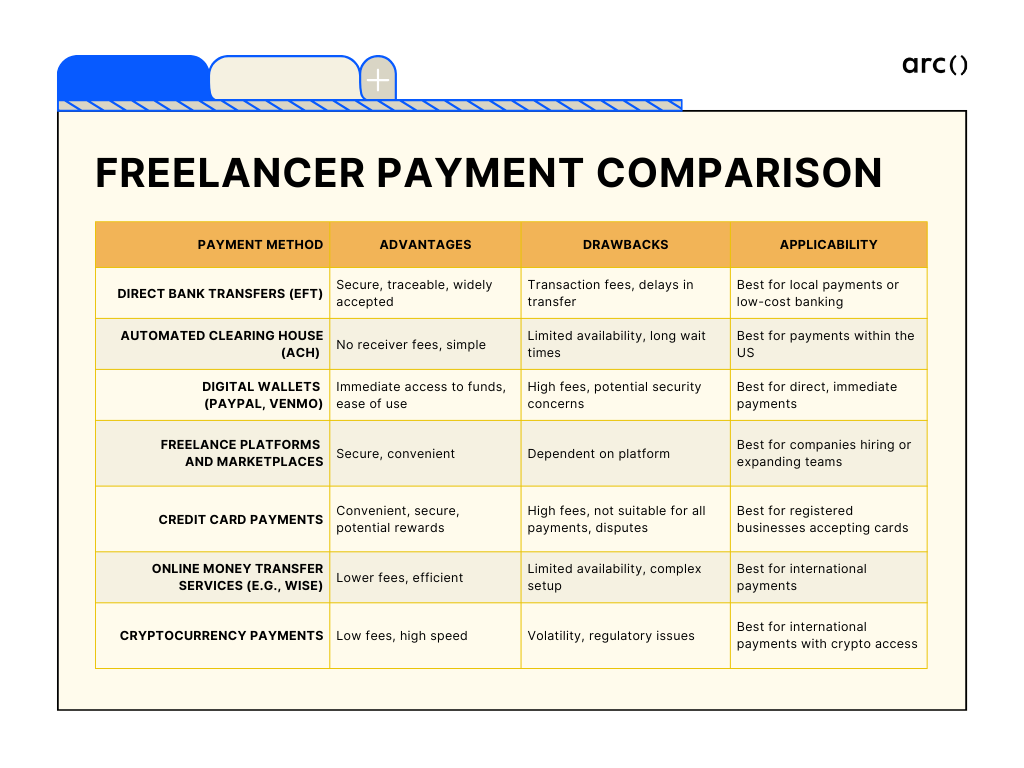

7 Main Types of Freelancer Payment Methods

Freelance payment methods can be broadly categorized into various types, each catering to a particular business needs. In this section, we’ve broken down the seven most popular ones:

1. Direct Bank Transfers (EFT)

Direct bank transfers, also known as electronic fund transfers (EFTs), are the most fundamental method of sending money. With this method, you can send payments electronically to your freelancers’ bank accounts.

Because this is a bank-to-bank payment method, your freelancers must have a bank account that can receive payments, locally or internationally.

Advantages

- Security: An EFT is probably the most secure, traceable transaction method for paying freelancers.

- Familiarity: It’s commonly used and accepted in almost all countries worldwide.

Drawbacks

- Transaction Fees: Your transaction fees can vary depending on where you are sending money. In the case of international transfers, the fees can sometimes exceed the amount you intend to send.

- Delay in Transfers: Some EFTs go through multiple channels and stakeholders, so payments can take several days to clear.

Applicability

Best option for paying freelancers locally or when you and your freelancer both have low-cost banking options.

2. Automated Clearing House (ACH)

With ACH, which stands for Automated Clearing House, you can electronically transfer payments from one U.S. bank account to another U.S. bank account in batches. For every transaction, you’ll be charged for remitting funds. Depending on the bank, the fee typically ranges from $0.50 to $10 per transaction.

Advantage

No Fees for the Receiver: ACH transactions are almost always free for the receiver. If you or your freelancer aren’t short on time, you can use ACH to make all your freelancer payments.

Disadvantages

- Limited Availability: If neither you nor your freelancer resides within the United States, ACH may not be a viable option for you. If you have a U.S. bank account, a way to circumvent this problem is to check if your freelancer is eligible — and willing to — open an appropriate bank account in the United States.

- Long Wait Time: Payment processing may take two to three business days to complete. This is because ACH transactions are released in batches, which can lead to long wait times for your freelancer.

Applicability

Best for payments within the United States.

3. Digital Wallets (PayPal, Venmo)

Digital wallets are probably the most familiar modes of freelancer payment. These financial apps are touted for their convenience and speed. They can also be accessed on the Internet via a browser or a smartphone.

Advantages

- Immediate Access to Funds: Funds transfer on these wallets within a few seconds.

- Ease of Use: These platforms are simple to set up and use. All you need to do is register your account and maybe upload some documents related to your business, and you’re good to go!

Drawbacks

- High Cumulative Fees: Transaction fees of these platforms can add up, especially when you use them frequently. Also, some wallets may not clearly explain their fee structure, requiring you to read their terms and conditions.

- Security Concerns: Some digital wallets can be less secure or traceable than conventional banking methods. Read online reviews and documentation to understand the security of the wallet you’re planning to use.

Arc Integration

Arc has integrated various digital wallets to offer you a seamless payment experience with additional layers of security and streamlined invoicing features.

Applicability

Best for companies looking to pay their freelancers directly and immediately.

4. Freelance Platforms and Marketplaces

One of the best ways to make secure freelancer payments is to hire remote talent from freelance platforms or work marketplaces, like Arc.

Arc is a global marketplace for remote talent that makes finding and paying freelancers easy. Once you hire someone through Arc, you can make direct freelancer payments via our platform. We support multiple modes of freelancer payments.

Applicability

Best for companies yet to hire freelancers or are looking to expand their freelancer or remote worker team.

Read more: The Best EOR Services: Deel vs Remote vs Oyster

5. Credit Card Payments

Another traditional payment method, credit cards, is a straightforward, traceable, and secure option for freelancer payments. However, your freelancer must be registered as a freelance business to receive payments.

Advantages

- Convenience: Credit cards are easy to use, with your payee receiving the money within a few seconds to minutes.

- Security from Frauds: Your credit card company or bank may have a zero liability policy, which can keep you safe from various kinds of unauthorized charges.

- Rewards: Some credit cards offer potential benefits from credit card reward programs, which can be very useful in the long run.

Drawbacks

- High Fees: Both you and the freelancer may incur high fees. The freelancer may need to pay about 3% of the total amount, while you may need to

- Cannot Be Used for All Payments: To receive payments, your freelancer must have a merchant account with your bank or use a payment service provider (PSP), like Payoneer or PayPal.

- Risk of Disputes: Credit cards are notorious for disputes and chargebacks.

Applicability

Best for paying freelancers with a registered business who can accept credit card payments or have a PSP (e.g., PayPal account).

Still want to use credit cards to pay your remote talent? Arc might be a great option for you.

6. Online Money Transfer Services (e.g., Wise)

When it comes to international online payments, services like Wise can be a cost-effective solution. Most of these services can help you make payments in multiple currencies to your payees’ overseas bank accounts.

Advantages

- Lower Fees: Online money transfers are typically cheaper than traditional bank transfers — or even credit card payments.

- Efficiency: Payments are completed within minutes, and each payment can be tracked.

Drawbacks

- Limited Availability: Several of these services may not be available in all countries. Before opting for a service, check the list of countries where it is available.

- Complexity: Setting up an account on these service platforms can be tedious and involve various steps, including document and beneficiary verification.

Applicability

Best for international payments.

7. Cryptocurrency Payments

Cryptocurrency is becoming a viable option for paying freelancers, especially for international transactions. Before using this mode of freelancer payments, you need to be well-versed with the nitty gritty of crypto — including blockchains and crypto wallets and exchanges.

Advantages

- Low Fees: Crypto transactions are generally cheaper than other modes of payment, especially bank transfers. You can save even more by using an advanced blockchain like Bitcoin and Ethereum.

- High Speed: Payments — local or international — go through directly and instantly to the payee.

Drawbacks

- Volatility: The value of cryptocurrency is highly volatile, so the exchange rates may be unpredictable at the time of payment.

- Regulatory Issues: Because of their novelty and volatility, the legal and tax implications of cryptocurrency use are still undefined in many regions.

Applicability

Best for paying freelancers with access to a crypto wallet.

Choosing the Right Payment Method

The right method for freelance payments will provide you with a balance between costs, convenience, and security. The advantages and drawbacks of the method you choose should complement your specific needs.

Using Arc find and pay global freelancers is also a smart choice. It’s easy and safe to send money to anyone you hire, and Arc helps resolve any disagreements if they arise. Find talented freelancers from around the world and start working with them quickly on Arc, saving you time and letting you focus on your projects.

Conclusion

Paying freelancers efficiently requires understanding your business needs and the available payment options. By considering the pros and cons of your preferred payment methods and using platforms like Arc, you can ensure a smooth payment process that fosters long-term relationships with your freelancers.

Looking to hire the best remote talent? See how Arc can help you:

⚡️ Find the world’s top developers, designers, and marketers

⚡️ Hire 4x faster with fully vetted candidates

⚡️ Save up to 58% with global hires