Looking to hire in the Philippines? Hiring employees in the Philippines could be smart for any business looking to tap into a skilled, cost-effective workforce.

The Philippines has become one of the best destinations for top remote talent, offering access to a highly educated, English-speaking workforce at significantly lower costs than countries like the U.S. and Europe. With a growing pool of professionals in software development, customer service, and creative roles, you can find the expertise you need to scale your team.

However, hiring in the Philippines comes with its own set of challenges. The country has strict labor laws, and compliance is crucial. These laws cover employee benefits, minimum wage, taxes, and workplace safety, so it’s essential to understand the legal framework.

Culturally, the Philippines values loyalty and strong personal relationships in the workplace. Understanding these dynamics can help you foster a positive work environment, whether your team is fully remote or hybrid.

Despite the legal and cultural considerations, the advantages of hiring in the Philippines are clear:

- Highly skilled, English-speaking workforce

- Competitive labor costs

- Cultural adaptability and strong work ethic

- Growing tech and creative talent pool

This guide will walk you through the legal, cultural, and practical aspects of the hiring process for Filipino workers in the Philippines, helping you have hassle-free remote hiring and build a compliant and effective remote team with ease.

Looking for top talent fast? See how Arc can help you:

⚡️ Find developers, designers, marketers, and more

⚡️ Freelance or full-time remote + fully vetted

⚡️ Save up to 58% with global hires

Hire top talent with Arc risk-free →

Popular Industries and Roles for Remote Work

Several industries in the Philippines have thrived due to their suitability for remote work. Customer support is one of the biggest industries, with many companies relying on the Philippines to hire a reliable virtual assistant for voice and non-voice support roles.

The software development industry is also growing rapidly, with a wealth of talented developers skilled in various programming languages. The creative sector is another area where Filipino virtual assistants excel, providing services in graphic design, digital marketing, social media, and content creation.

Other common roles include virtual assistants, data entry, project management officers, and back-office support—positions that enable business growth and maintain efficiency without incurring high labor costs.

Legal Requirements for Hiring in the Philippines

When hiring in the Philippines, understanding the country’s legal framework is critical. The Philippines has a detailed and employee-friendly labor code designed to protect workers’ rights while ensuring fair and just employment practices. This section will cover the essential legal requirements you need to know to ensure compliance with Philippine labor laws.

The Philippine Labor Code serves as the foundation for all employment laws in the country. It regulates everything from minimum wage and working hours to employee benefits and workplace safety.

Employers must adhere to these guidelines to avoid penalties and ensure smooth operations when hiring local talent. The Labor Code also governs the types of contracts allowed, the protection of workers’ rights, and the responsibilities of employers in providing a safe and healthy work environment.

Minimum Wage, Contributions, and Taxes

In the Philippines, the minimum wage varies depending on the region, but in Metro Manila, it’s around PHP 645 per day (roughly USD 11.52). Employers are also required to make regular contributions to three primary government programs:

- Social Security System (SSS)

- PhilHealth (Philippine health insurance corporation)

- Pag-IBIG (a government-run savings and housing program)

These mandatory contributions provide employees a safety net in retirement, health care, and housing.

In addition to contributions, taxes must be correctly withheld and filed with the Bureau of Internal Revenue (BIR). Understanding how to comply with these requirements is key to maintaining a smooth relationship with your virtual workers and local authorities.

Compliance and Payroll for Filipino Employees

Managing compliance and payroll in the Philippines requires a clear understanding of the local regulations governing employee rights, tax obligations, and required contributions to government programs. Ensuring payroll accuracy and timely submission of taxes and benefits is crucial for maintaining a good relationship with employees and avoiding penalties.

Payroll Cycle and Tax Obligations

In the Philippines, employees are typically paid on a semi-monthly basis, with paydays falling on the 15th and end of the month. For each payroll cycle, employers are responsible for withholding the appropriate amount of income tax and remitting it to the Bureau of Internal Revenue (BIR), along with required contributions for SSS, PhilHealth, and Pag-IBIG.

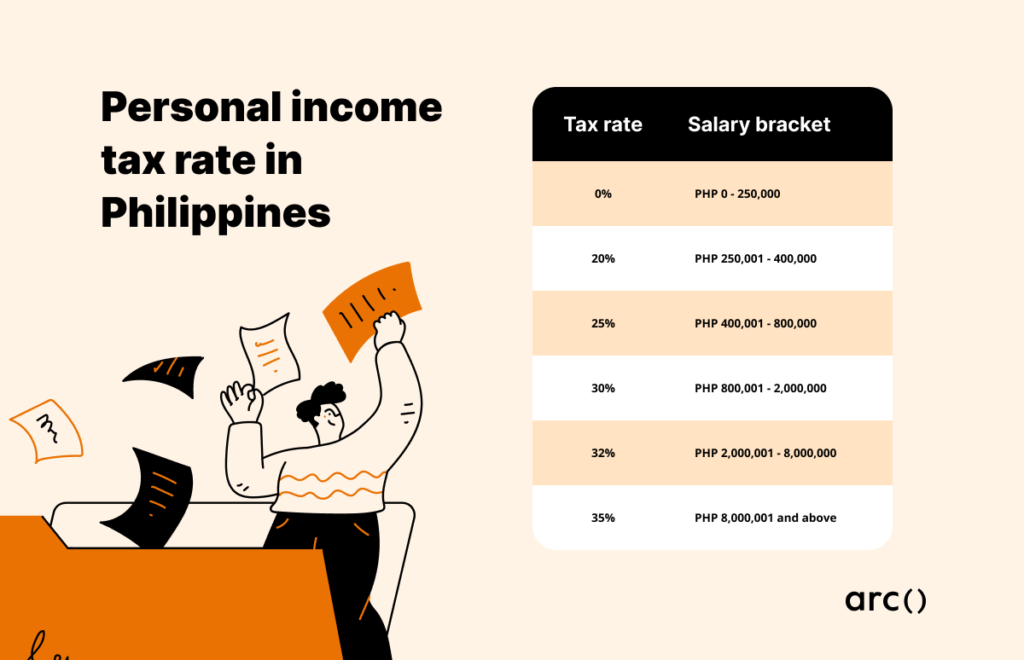

Income Tax Obligations: Understanding the TRAIN Law

The Tax Reform for Acceleration and Inclusion (TRAIN) Law, implemented in January 2018, has significantly impacted income tax rates for employees in the Philippines. The TRAIN Law introduced lower personal income tax rates for employees earning less than PHP 8 million annually and simplified the tax structure to make it easier for both employees and employers to comply.

Employers must ensure that income tax is accurately withheld based on these rates and remitted to the BIR on a monthly basis.

Employee Benefits and Contributions

When hiring in the Philippines, it’s important to be aware of the mandatory employee benefits required by law, as well as additional perks that can help you attract and retain top talent. Offering competitive benefits packages is crucial, especially in a market where companies are increasingly seeking highly skilled Filipino professionals.

Mandatory Benefits

The Philippine government mandates a set of benefits that every employer must provide to full-time employees. These benefits are crucial for employee welfare and are non-negotiable when operating within the country. Below are the key government-mandated benefits:

13th Month Pay

All employees in the Philippines are entitled to a 13th-month pay, which is calculated as at least 1/12th of their total basic salary earned within the year. This pro-rated amount must be paid by the employer on or before December 24 each year, as mandated by Presidential Decree No. 851. It is important to note that this statutory benefit is separate from any bonuses or incentives an employer may provide.

Social Security System (SSS) Contributions

The Social Security System (SSS) is the Philippines’ social insurance program, which provides benefits such as retirement, disability, sickness, maternity, and death benefits. The SSS contribution is shared by both the employer and employee. For 2024, the contribution rate is 14% of the employee’s monthly salary credit (MSC), with the employer contributing 9.5% and the employee contributing 4.5%. The salary ceiling for contributions is set at PHP 30,000.

PhilHealth Contributions

PhilHealth is the national health insurance program that provides healthcare coverage for employees and their dependents. As of 2024, the PhilHealth contribution rate is 5% of the employee’s monthly salary, equally shared between the employer and employee. The maximum salary base for PhilHealth contributions is PHP 100,000.

Pag-IBIG Fund (HDMF) Contributions

The contribution rate varies depending on the type of employment (e.g., private/employed, voluntary/self-employed, etc.). However, for private/employed members, the maximum monthly contribution for both the employee and employer has increased to PHP 200.

The Pag-IBIG Fund is a government-run home development mutual fund that provides housing loans and financial assistance. Employers and employees are each required to contribute 2% of the employee’s monthly salary, with a salary cap of PHP 5,000. This means the maximum contribution is now PHP 100 per month for both the employee and employer, bringing the total to PHP 200.

Paid Leave

Employees in the Philippines are entitled to a minimum of five days of service incentive leave annually after one year of employment, which can be used for vacation or sick leave. Employers may choose to provide more paid leave days as part of a competitive benefits package.

- Maternity Leave: Female employees are entitled to 105 days of paid maternity leave (an additional 15 days if the employee is a solo parent), with an option to extend for another 30 days of unpaid leave.

- Paternity Leave: Male employees are entitled to 7 days of paid paternity leave for the first four deliveries of their spouse or partner.

- Solo Parent Leave: Single parents are entitled to an additional 7 days of leave annually under the Solo Parents’ Welfare Act.

Overtime Pay and Holiday Pay

Employees in the Philippines are entitled to overtime pay if they work beyond the standard 8 hours per day. This overtime is compensated at 125% of the regular hourly rate for weekday work. The compensation for work performed on holidays increases to 200% for regular holidays and 130% for special holidays.

Under Philippine law, employees are entitled to a Night Differential—an additional 10% of the regular hourly rate for work performed between 10 PM and 6 AM .

Additional Benefits Employers Can Offer

In addition to these mandatory benefits, offering additional perks can make your company more attractive to prospective employees, especially in competitive fields like technology and customer support. Here are some optional but valuable benefits:

Health and Wellness Programs

Many companies in the Philippines offer additional healthcare benefits, such as Health Maintenance Organization (HMO) coverage, which provides private medical care for employees. Employers often extend this coverage to the employee’s dependents as well. Offering mental health support and wellness programs, such as gym memberships or counseling, can also be valuable in ensuring employee well-being.

Performance Bonuses and Incentives

While the 13th-month pay is mandatory, many companies also provide performance-based bonuses or other financial incentives to reward high-performing employees. These bonuses can vary depending on company goals and profitability but are highly appreciated in motivating and retaining talent.

Retirement Plans

Beyond the mandatory SSS retirement benefits, some employers offer additional retirement savings plans, such as matching contributions to a private retirement fund. This can be a significant differentiator when hiring senior professionals or employees seeking long-term career stability.

Flexible Working Arrangements

Offering flexible work hours or remote work options in the job description is becoming increasingly popular, especially in industries where Filipino talent is in high demand. Providing flexibility can significantly improve work-life balance and employee satisfaction, making your company more attractive to top candidates.

Transportation and Meal Allowances

Some employers provide transportation allowances or company shuttles, especially for employees commuting long distances. Additionally, meal allowances or meal subsidies during working hours are common, particularly for businesses operating in urban areas where the cost of living is higher.

Professional Development and Training

Providing opportunities for skill development, training, or even covering certification fees can be highly appealing for Filipino professionals. Many employees appreciate employers who invest in their career growth, making training programs a great tool for talent retention.

You can also try Arc, your shortcut to the world’s best remote talent:

⚡️ Access 350,000 top developers, designers, and marketers

⚡️ Vetted and ready to interview

⚡️ Freelance or full-time

Try Arc and hire top talent now →

Avoiding Misclassification of Employees

Misclassifying employees as independent contractors can lead to penalties, fines, and back payments. The Philippine government is strict about ensuring workers are classified correctly, and businesses must adhere to clear distinctions between contractors and full-time employees. Arc can help you navigate this and ensure compliance with local regulations.

Cultural Considerations in the Philippines

Understanding the cultural nuances of Filipino workers is essential for building strong, effective remote teams. Filipinos are known for their friendliness, respect for hierarchy, and dedication to their work, but their communication and work styles may differ from what you’re accustomed to. Building trust and rapport with your team is key to success.

Building Personal Relationships

In Filipino work culture, relationships matter. Filipinos tend to value personal connections with their colleagues, and this extends into the professional realm. Taking a few minutes at the beginning of a meeting for casual conversation or “small talk” can help build rapport and trust.

It’s not just about business—asking about someone’s family, weekend plans, or even how their day is going creates a friendly and supportive atmosphere. This personal touch fosters loyalty and helps remote workers feel like they are part of a team, even when working from a distance.

By nurturing these relationships, you’ll find that your Filipino employees are more engaged and willing to go the extra mile because they feel valued not just as workers, but as people.

Practicing Clear and Respectful Communication

While Filipinos generally prefer clear and direct communication, it’s essential to balance this with respect and consideration for the other person’s feelings. Filipinos tend to avoid confrontational language, as they place high importance on maintaining hiya, or a sense of dignity. This means that even when giving instructions or feedback, it’s important to be mindful of your tone.

Phrase your feedback or directions in a way that’s constructive rather than critical, and avoid making anyone feel embarrassed in front of their peers. By maintaining a respectful tone, you’ll encourage open communication without disrupting the positive work environment you’ve built.

Encouraging Feedback

Creating an environment where employees feel comfortable sharing their thoughts and concerns can be a challenge. Filipino workers may be less likely to voice disagreement or critique, especially if they feel it may disrupt harmony. This is where building trust becomes vital.

Encourage your team to share their opinions by making it clear that you value their input and that there won’t be negative consequences for speaking up. One way to achieve this is through regular one-on-one meetings, where employees might feel more comfortable opening up. Additionally, showing appreciation for their feedback and acting on suggestions can reinforce the idea that their voices matter.

This culture of open feedback is essential for continuous improvement and fostering innovation within your remote team. So, whenever possible, you can schedule interviews with your remote team in the Philippines to talk to them about their work performance.

Hiring Process and Retention Practices for Filipino Workers

Effectively onboarding and retaining your Filipino employees is crucial to maintaining a productive remote team. By ensuring that your employees feel welcomed, valued, and supported, you can foster long-term engagement and reduce turnover.

Best Practices for Onboarding Remote Employees

Onboarding is your first chance to set the tone for a positive, productive relationship. In the Philippines, it’s important to not only introduce new employees to their job roles but also integrate them into the team and company culture. A structured onboarding program should include clear training schedules, regular check-ins, and access to all necessary resources.

During the onboarding phase, it’s also helpful to emphasize the company’s mission and values, as Filipinos appreciate understanding the bigger picture of their work and how they contribute to the overall success of the business.

Strategies for Retaining Top Talent

Once onboard, keeping your team members motivated and satisfied is key to long-term success. Offering professional development opportunities is one of the best ways to retain Filipino talent. Filipinos are eager learners and value opportunities for growth, so providing access to training, certifications, or workshops can enhance their loyalty to your company.

Additionally, recognition and rewards go a long way. Whether it’s a public acknowledgment of a job well done or performance-based bonuses, showing appreciation for your employees’ efforts helps build a positive work environment. Lastly, offering a healthy work-life balance is crucial. Flexible hours and a supportive environment that respects personal time can go a long way toward ensuring long-term employee retention.

Cost Savings of Hiring Employees from the Philippines

More and more companies are turning to the Philippines for talent. Hiring employees in the Philippines can be a great cost-saving avenue for your business.

For example, while U.S.-based freelance software developers typically charge between $110 and $150 per hour, their Filipino counterparts ask for around $2 to $6 per hour — translating to up to 80% savings. When comparing full-time salaries, you’ll also find notable savings.

For non-developer roles, the savings are just as impressive. In the U.S., freelance graphic designers and marketers charge $70 to $135 per hour. Similar professionals in the Philippines charge only $2.39 to $5.18 per hour. This means you can access high-quality workers for less than 90% off the price.

Savings are especially beneficial if you run a startup or a small business that wants to stretch its budget without sacrificing quality. These cost savings also allow you to invest in more resources, grow your team, or enhance other business areas.

In short, the Philippines is a smart choice for cost-effective, high-quality talent. It offers excellent quality for a fraction of the price.

Save up to 80% on key hires by accessing top global talent. See how Arc can help: ️ Hire developers, designers, marketers, and more

️ Hire developers, designers, marketers, and more ️ Freelance or full-time remote—fully vetted professionals

️ Freelance or full-time remote—fully vetted professionals ️ Save up to 60% with global hires

️ Save up to 60% with global hires

Discover your potential savings →

Hiring Options in the Philippines

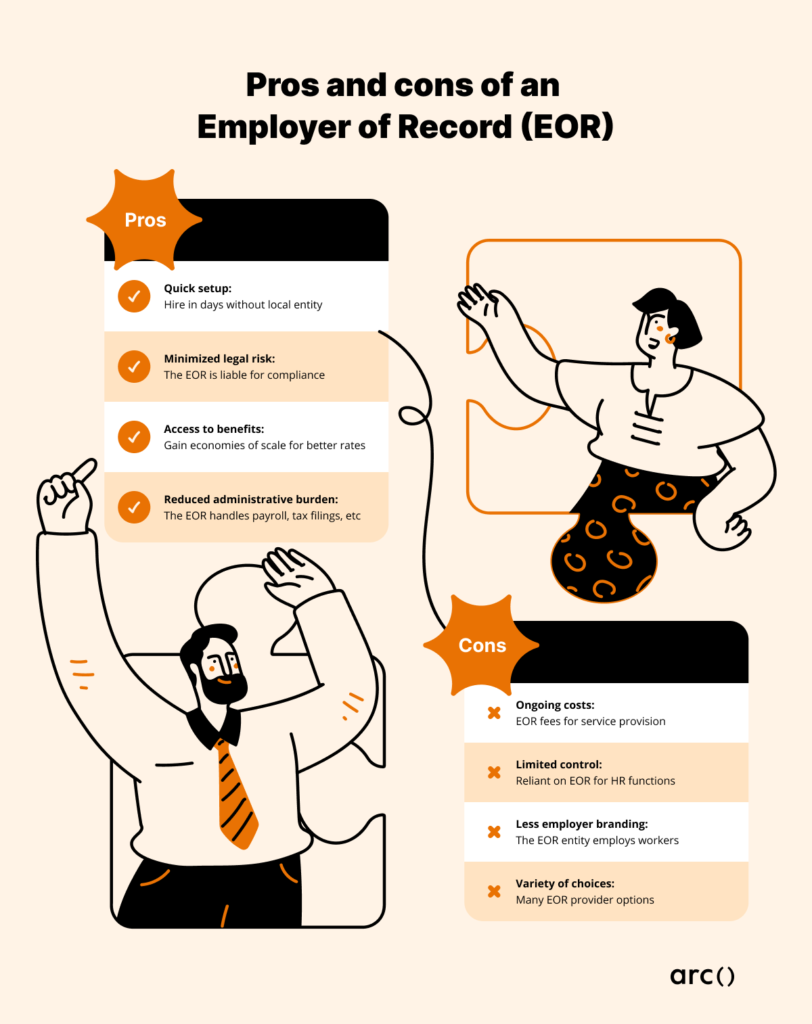

When expanding your business to the Philippines, you have several hiring options. Deciding between setting up a local entity, using an Employer of Record (EOR), or hiring contractors depends on your business goals and size. It also depends on the level of commitment you want to establish in the country.

Setting up an Entity vs. Using an Employer of Record (EOR)

Setting up a legal entity may be the best option if you’re looking to hire many employees and establish a long-term presence in the Philippines. However, the process can be time-consuming and costly. This can involve registration with various government agencies, securing permits, and complying with local employment laws.

For businesses that want to hire virtual assistants quickly and avoid the complexities of establishing a local presence, using a recruitment service or an Employer of Record (EOR) is an excellent alternative. Arc partners with EOR providers who handle everything from recruitment and scheduling interviews to legal compliance and payroll. This allows you to hire top talent without the administrative burden.

Hiring Contractors vs. Full-Time Employees in the Philippines

If flexibility is your priority, hiring contractors might be the right option. Contractors offer short-term solutions without the long-term obligations of full-time employees. However, it’s important to ensure you don’t misclassify employees, as this could lead to legal challenges.

On the other hand, hiring full-time employees provides more control and stability, especially if you’re looking for long-term relationships. An EOR helps manage contracts, compliance, and benefits for full-time employees, ensuring everything is in line with local laws.

Hire Employees in the Philippines

Hiring in the Philippines presents incredible opportunities for businesses seeking cost-effective, high-quality talent. From a skilled and adaptable workforce to major cost savings, the benefits are clear.

Ready to take the next step? Sign up for Arc today to learn more about how Arc can help your business thrive in the global talent market.

Looking for top talent fast? See how Arc can help you:

⚡️ Find developers, designers, marketers, and more

⚡️ Freelance or full-time remote + fully vetted

⚡️ Save up to 58% with global hires