Looking to hire from Colombia? Hiring employees in Colombia could be a strategic move for your business, no matter where it’s based.

Colombia offers a highly-skilled, bilingual workforce at lower labor costs than the U.S. and Europe. However, it’s essential to navigate Colombia’s comprehensive employment laws, which cover everything from wages and benefits to contracts and compliance with social security regulations.

Colombian workplace culture also plays a vital role in business success, where personal relationships and respect for hierarchy shape team dynamics.

Despite these legal and cultural considerations, hiring in Colombia provides numerous advantages, including:

- Access to cost-effective, skilled talent

- A bilingual workforce with strong educational backgrounds

- Expertise in key industries like tech and finance

This guide will help you understand Colombia’s labor regulations and cultural nuances, allowing you to easily tap into its top talent.

Looking for top talent fast? See how Arc can help you:

⚡️ Find developers, designers, marketers, and more

⚡️ Freelance or full-time remote + fully vetted

⚡️ Save up to 58% with global hires

Hire top talent with Arc risk-free →

Legal Requirements for Hiring in Colombia

Before you go through the hiring process in Colombia, you need a clear understanding of local labor laws to ensure compliance and avoid potential legal pitfalls.

The primary legislation governing employment in Colombia is the Código Sustantivo del Trabajo (Substantive Labor Code), which covers everything from wages to working conditions and termination procedures. Employers must ensure they comply with Colombian labor code to avoid legal issues.

Types of Employment Contracts:

- Oral Contracts: Used for short-term work arrangements, but difficult to prove if disputes arise.

- Written Contracts: Highly recommended, as they clearly outline job duties, compensation, and other terms.

- Electronic Contracts: Legally binding and commonly used for remote or freelance workers since it’s mostly fixed term contracts.

Employment Contracts in Colombia

When hiring in Colombia, having a detailed employment contract that complies with local laws is essential. A well-drafted contract should include:

- Identification of Parties: Full details of both employer and employee.

- Job Description: Clearly defined duties and responsibilities.

- Compensation: Outline of salary, benefits, and bonuses.

- Working Hours: Specify normal hours and any conditions for overtime.

- Duration of Employment: Indicate whether the contract is fixed or indefinite.

- Probationary Periods: Typically two to six months, during which the employer can assess the employee’s performance.

- Termination Clauses: Conditions for ending the employment, including notice periods and severance requirements.

It’s common to renew contracts, particularly for fixed-term arrangements, and employers should ensure all renewals meet the requirements of Colombian labor law.

Compensation and Benefits in Colombia

Understanding compensation standards and benefits is key when hiring in Colombia.

Minimum Wage for Employees in Colombia

As of 2024, the minimum wage in Colombia is set at approximately 1,300,606 Colombian pesos per month, which equates to around $310 USD. This amount is regulated by the Colombian government and is revised annually to account for inflation and the cost of living.

The minimum monthly wage applies to all employees regardless of industry or job function and includes an additional mandatory transportation subsidy for those earning less than twice the minimum wage. As of 2023, this transportation subsidy amounts to 162,000 COP (around $42 USD) per month.

For skilled professionals in specialized fields like IT, engineering, finance, and marketing, salaries are often much higher. For example, a software developer in Colombia can earn between $1,000 and $3,500 USD per month, depending on factors such as experience, specialization, and company size.

Senior engineers or managers may earn even more, particularly if they work for international companies or in high-demand areas like AI, blockchain, or cloud infrastructure. It’s also important to note that salaries exceeding 16 million COP per month (approximately 13 times the minimum wage) are classified as “Salario Integral,” which alters the applicable benefits and income tax brackets.

Additionally, offering benefits such as bonuses, health insurance, and flexible work arrangements can further enhance the attractiveness of your compensation package in a competitive market.

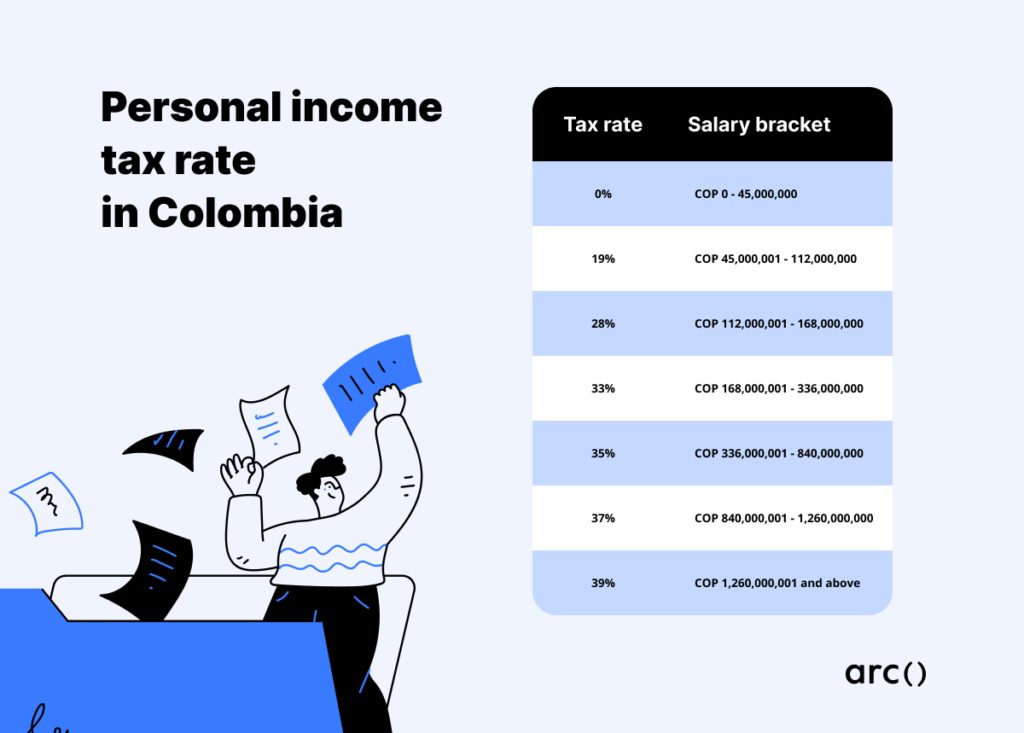

Tax Obligations and Social Security Contributions in Colombia

When hiring employees in Colombia, employers must adhere to specific tax obligations and social security contributions, which are regulated by Colombian law. These contributions are mandatory and are shared between the employer and the employee. Below is a breakdown of the tax obligations for employers:

Employer Contributions

- Pension Contributions: Employers must contribute 12% of the employee’s gross salary to the pension system. This contribution goes toward providing retirement benefits for employees.

- Health Insurance Contributions: Employers must contribute 8.5% of the employee’s salary to the national health insurance system. This ensures employees and their families have access to healthcare services.

- Occupational Risks Insurance (ARL): Depending on the level of risk associated with the job, employers must contribute between 0.522% and 6.96% of the employee’s salary toward occupational risk insurance. This insurance covers workplace accidents or injuries.

- Family Welfare Fund (Caja de Compensación Familiar): Employers must contribute 4% of the employee’s salary to a family welfare fund. This fund provides employees with social benefits, including daycare services, recreational activities, and educational programs for their families.

- Institute of Family Welfare (ICBF): Employers must contribute 3% of the employee’s salary to the Colombian Institute of Family Welfare, which provides resources and services for children and families.

- National Training Service (SENA): A 2% contribution of the employee’s salary must be paid to the National Training Service (SENA), which offers vocational training programs for workers.

Failing to comply with these contributions can result in penalties or legal action, so employers must stay on top of these obligations. Arc’s EOR partners ensure full compliance with all tax and social security requirements, simplifying the business process.

You can also try Arc, your shortcut to the world’s best remote talent:

⚡️ Access 350,000 top developers, designers, and marketers

⚡️ Vetted and ready to interview

⚡️ Freelance or full-time

Try Arc and hire top talent now →

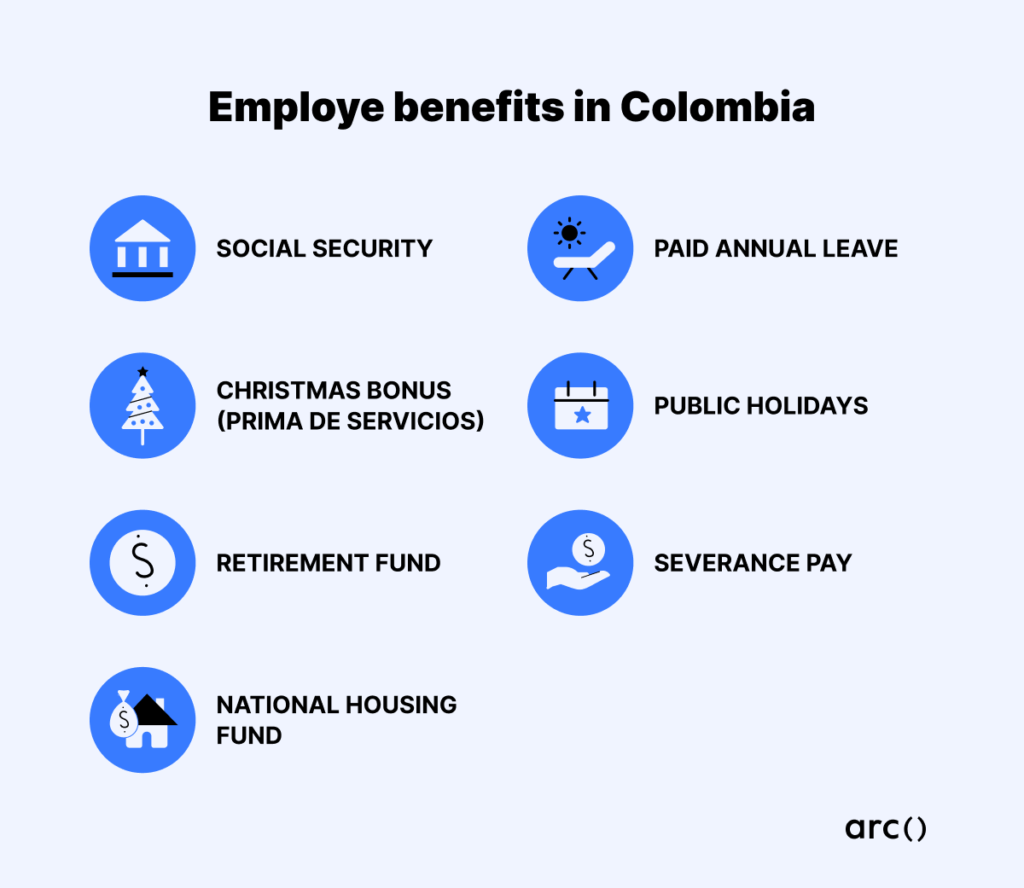

Mandatory Benefits for Colombian Employees

In Colombia, employers are required to pay employees an additional range of mandatory benefits to ensure their employees’ well-being and financial security. These benefits are stipulated by law and include contributions to health insurance, pensions, severance, and various types of paid leave. Here’s a detailed breakdown of the key mandatory benefits:

Health Insurance

Employers in Colombia must contribute 8.5% of an employee’s salary to the national health insurance system, while employees contribute 4% of their gross salary. This system provides employees and their immediate families access to healthcare services, including medical consultations, hospitalizations, surgeries, and prescription medications.

Employers must register their employees with one of the health insurance providers (EPS), which are either public or private entities authorized to administer healthcare coverage under the national system.

Pension

The Colombian pension system requires contributions from both employers and employees to ensure that workers have access to retirement funds when they retire. Employers contribute 12% of the employee’s salary to the national pension fund, while employees contribute 4% of their gross salary.

Employees in Colombia can choose between two types of pension systems:

- Public Pension System (Colpensiones): Managed by the state, providing fixed pensions based on contributions and the length of time an employee has worked.

- Private Pension Funds: Managed by financial institutions, where employees’ contributions are invested, and their pension is based on the returns from those investments.

In either system, employees are eligible for pension benefits once they reach the retirement age—62 for men and 57 for women—or after contributing for a minimum of 1,300 weeks.

Paid Leave

Employees in Colombia are entitled to several types of paid leave as part of their legal benefits:

- Vacation Leave: Employees are entitled to 15 consecutive working days of paid vacation for every year of service. Vacation days can be divided, but at least six days must be taken consecutively.

- Sick Leave: If an employee is unable to work due to illness, they are entitled to paid sick leave. The employer pays the first two days of sick leave, employees who need more time off must alert the national health system to cover the remaining days, typically up to 180 days. Sick leave pay is typically 66% of the employee’s salary, although the employer may choose to top it up.

- Maternity Leave: Female employees receive 18 weeks of paid maternity leave, which can start one to two weeks before the expected due date. The health insurance provider covers the cost of maternity leave.

- Paternity Leave: Fathers are entitled to two weeks of paid paternity leave, with pay covered by the national health system.

In addition to these, employees also receive public holidays, which vary by region. Colombia has 18 national holidays, during which employees receive paid leave.

Severance Pay

Employers must contribute 8.33% of the employee’s annual salary to a severance fund, known as cesantías, which is designed to provide financial support to employees upon termination, resignation, or during periods of unemployment.

The severance payment is equivalent to one month’s salary for each year of service. Employers need to deposit this amount into a severance fund at the end of each year, which employees can later access.

Additionally, employers must pay interest on the severance, at a rate of 1% annually, which they pay directly to the employee at the end of each year. The employee can also withdraw from their severance fund in advance for specific reasons, such as purchasing a home or paying for higher education.

Additional Benefits

To attract and retain top talent, many employers in Colombia go beyond the mandatory benefits and offer additional perks, which can greatly enhance an employee’s job satisfaction and loyalty:

- Bonuses: Performance-based or year-end bonuses are common and can help motivate employees to achieve better results and promote a healthy work-life balance. These can be based on company performance, individual performance, or a combination of both.

- Meal Allowances: Some companies offer meal allowances or provide access to subsidized cafeterias for employees. This can be especially beneficial in urban areas where the cost of living is higher.

- Transportation Subsidies: Employees earning less than twice the minimum wage get a mandatory transportation subsidy. In 2024, this subsidy amounts to 162,000 COP (around $38.62 USD) , helping to cover daily commuting costs.

- Professional Development: Offering opportunities for continuing education, such as workshops, courses, or funding for further education, can be a significant benefit. Employees in Colombia appreciate opportunities to develop their skills and improve their career prospects.

- Flexible Work Arrangements: In the post-pandemic era, offering remote work options, flexible schedules, or a hybrid work model has become an attractive benefit for many professionals, particularly in high-demand fields such as technology and marketing.

Working Hours and Overtime in Colombia

In Colombia, the standard working week is 46 hours, with a maximum of 8 hours per day. Companies allow overtime work but they must pay employees at a higher rate:

- Daytime Overtime Pay: Paid at 1.25 times the regular hourly rate for the first two hours, and 1.75 times for additional hours.

- Nighttime Overtime Pay: Paid at 1.35 times the regular rate for the first two hours, and 1.85 times for additional hours.

- Weekend and Holiday Work: Paid at 1.75 times the normal rate, with even higher rates if performed at night.

Employers must carefully track working hours and overtime to ensure compliance with Colombian labor laws.

Termination of Employment

Termination of an employment contract in Colombia must follow specific legal guidelines:

- Just Cause: Employers can terminate staff for serious misconduct, repeated policy violations, or other valid reasons.

- Notice Periods: For indefinite contracts, there is a required 30-day notice period.

- Severance Pay: If an employee is terminated without just cause, they are entitled to severance pay based on their tenure with the company.

Employees also have the right to challenge their termination if they believe it was unjust, so employers should handle termination carefully to avoid legal disputes.

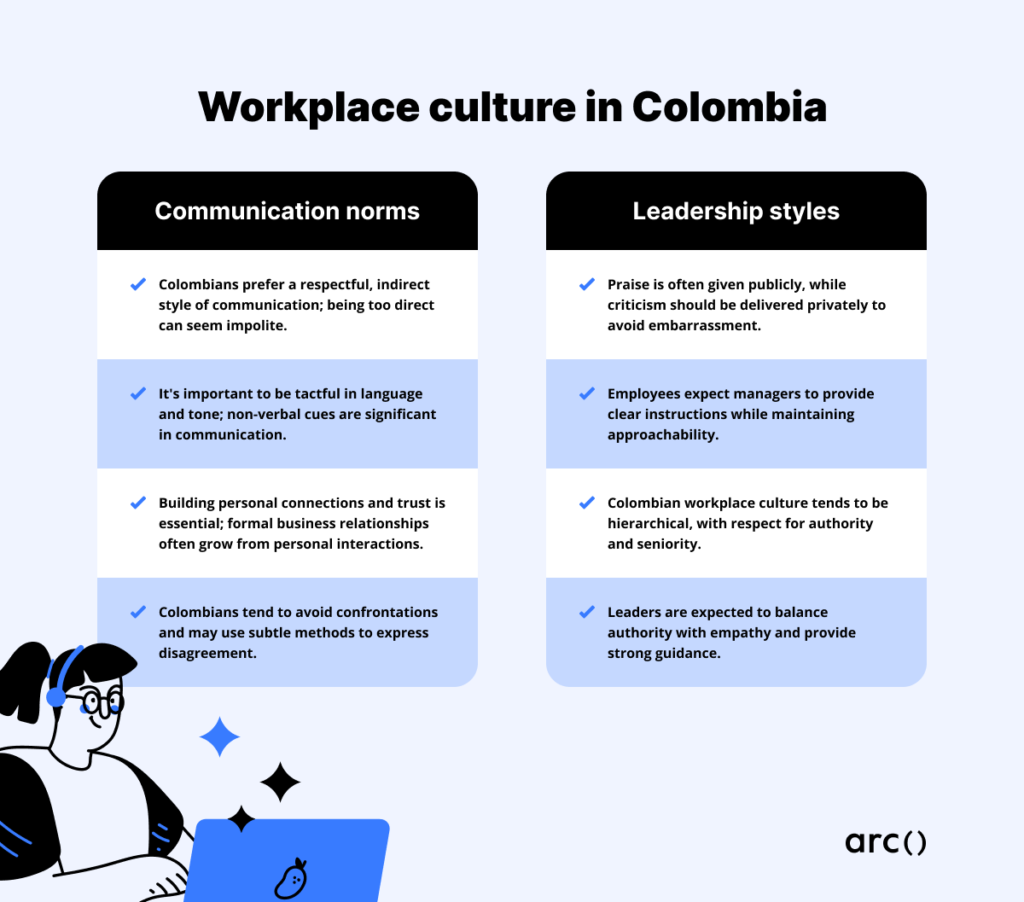

Cultural Considerations for Colombian Employees

Understanding the work culture is crucial for building strong relationships and ensuring effective teamwork when hiring and collaborating with Colombian employees.

Relationship Building

In Colombia, personal relationships are at the heart of business interactions. Colombians tend to prioritize trust and familiarity over purely transactional engagements. It’s common for business discussions to start with casual conversations to establish rapport before diving into work-related matters.

Getting to know your Colombian employees or partners personally can go a long way in building a strong, trusting relationship. Small gestures like asking about their family or engaging in lighthearted topics can create a more open and productive work environment. Building this foundation of trust is essential, as Colombians prefer to work with people they feel comfortable with.

Communication

Clear and respectful communication is key in Colombian work culture. While Colombians appreciate directness, it’s important to approach conversations in a way that maintains harmony.

Avoid overly confrontational language or being too blunt, Colombians may perceive this as rude. Instead, focus on open dialogue that encourages collaboration and constructive feedback.

When discussing issues or giving feedback, use a respectful tone to ensure the conversation remains positive and solution-focused. Establishing this type of communication fosters a culture of respect and cooperation, which Colombians value in their workplace.

Punctuality

Punctuality is generally important in Colombian business settings, particularly in more formal environments. While they appreciate being on time, they also expect a bit of flexibility.

Meetings may start slightly late, and last-minute changes or delays are common. It’s important to prepare for this and remain adaptable.

When scheduling meetings or setting deadlines, build some buffer time to account for unexpected changes. While they respect timeliness, understanding the cultural norm of flexibility will help you navigate business interactions more smoothly.

Hierarchy

Colombian work culture tends to be hierarchical, with clear distinctions between management and employees. There is a strong respect for authority, and decisions often follow the chain of command. Recognizing and respecting these organizational structures when working with Colombian teams is important.

Managers or senior leaders are typically responsible for making the final decisions, and their team respect their authority. When addressing or interacting with senior team members, showing deference to their position can help maintain a harmonious work dynamic.

However, teams encourage collaboration, and employees openly share ideas and work together towards common goals, as long as they respect the chain of command.

Cost Savings of Hiring Employees from Colombia

More and more companies are turning to Colombia for talent. Hiring employees in Colombia can be a great cost-saving avenue for your business.

For example, while U.S.-based freelance software developers typically charge between $110 and $150 per hour, their Colombian counterparts ask for around $51 to $75 per hour — translating to up to 50% savings. When comparing full-time salaries, you’ll also find notable savings.

For non-developer roles, the savings are just as impressive. In the U.S., freelance graphic designers and marketers charge $70 to $135 per hour. Similar professionals in Colombia charge only $7 to $20 per hour. This means you can access high-quality workers for more than half the price.

Savings are especially beneficial if you run a startup or a small business that wants to stretch its budget without sacrificing quality. These cost savings also allow you to invest in more resources, grow your team, or enhance other business areas.

In short, Colombia is a smart choice for cost-effective, high-quality talent because it offers excellent quality for a fraction of the price.

Save up to 80% on key hires by accessing top global talent. See how Arc can help: ️ Hire developers, designers, marketers, and more

️ Hire developers, designers, marketers, and more ️ Freelance or full-time remote—fully vetted professionals

️ Freelance or full-time remote—fully vetted professionals ️ Save up to 60% with global hires

️ Save up to 60% with global hires

Discover your potential savings →

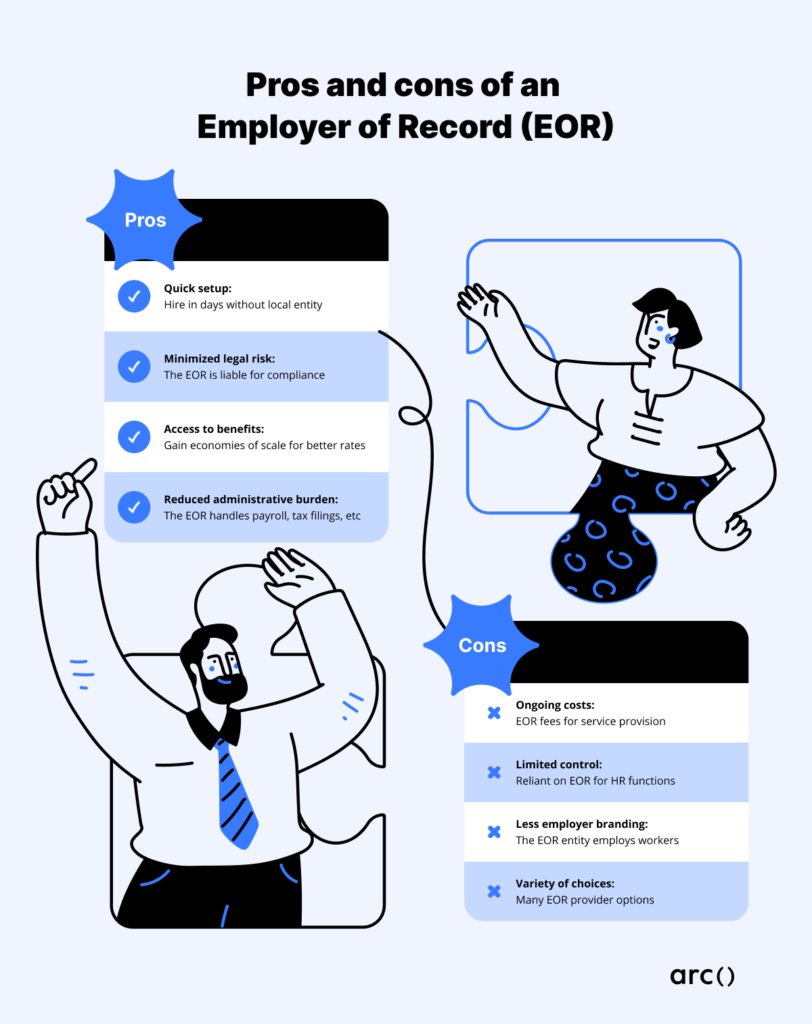

Hire Employees in Colombia

Hiring in Colombia offers a wealth of benefits, from significant cost savings to access to highly skilled professionals. But navigating the legal, tax, and cultural aspects of hiring in a foreign country can be challenging.

That’s where Arc’s Employer of Record (EOR) partners come in . They simplify the process, ensuring full compliance while helping you build a strong, cost-effective team with ease.

Ready to start? Sign up to Arc today, and we’ll connect you with the right EOR partner to help you build your dream team in Colombia!

Looking for top talent fast? See how Arc can help you:

⚡️ Find developers, designers, marketers, and more

⚡️ Freelance or full-time remote + fully vetted

⚡️ Save up to 58% with global hires