FP&A Analyst

Location

Seniority

Who we are...

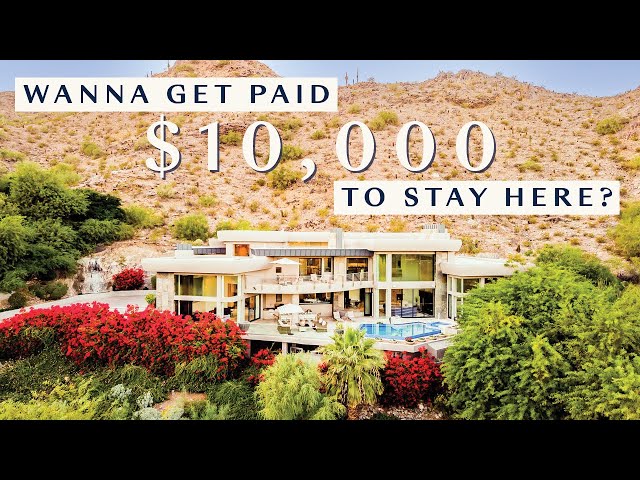

AvantStay delivers exceptional, unique stays for group travelers. The company has built a tech-enabled millennial hospitality brand to be the new standard for group experience. We are venture funded and growing rapidly in the explosive $100+ billion dollar STR industry.

What we are looking for…

As an analyst at AvantStay, you will have unique visibility across the entire company and serve as a key liaison between our teams. You will turn your analyses into deep insights, communicate these insights to key stakeholders and executives, and drive strategic decision making. You will work cross-functionally and empower leaders across the company by delivering strategic analyses and actionable insights.

What you’ll do…

- Partner effectively with functional teams to produce and prepare monthly, quarterly and annual forecasts / budgets, tracking them against actual performance, and delivering insights to management

- Prepare weekly, monthly, and quarterly reports and presentations, including work to be presented to company executives and the Board of Directors, and assist with the fundraising process, which will provide you with exposure to world-class venture capital funds

- Develop and maintain department-specific financial models and dashboards to provide business leaders and managers with insights into their KPIs.

- Maintain company operating model and work with executive team for raising equity and debt capital through various rounds of complex financing

- Work closely with the FP&A, Accounting and Finance Operations Teams to identify risks and opportunities to property level P&Ls, and implement strategies to improve or resolve

- Build complex models that support the implementation, execution and progress, of innovative and strategic decisions

- Improve financial insights by analyzing results; monitoring variances; identifying trends; and recommending actions to management

- Support scoping and buildout of requirements for enterprise planning solution for the Corporate Finance function

- Assist in analyzing potential investments including market and financial analyses

- Perform acquisition due diligence including the review of leases, financial conditions, historical property operating results, financial assumptions and other information

Requirements

What you’ll bring…

-

Experience: 3-5 years overall experience in public company and/or high-growth startup. FP&A, Strategic Finance, or other Corporate Finance roles. Experience in Hospitality or Real Estate is a plus.

-

Qualifications: Bachelor’s degree in a related field.

-

Knowledge: You have a strong business acumen and know that problem-solving goes beyond the numbers. You can think through multiple scenarios and apply strategic judgment to assist with decision making.

-

Natural talent and energy: You are a self-starter and have a bias for action. You will have a unique opportunity to help implement enterprise-level financial infrastructure, create new analyses and cross-functional projects.

-

Excellence: Advanced proficiency in Microsoft Excel, demonstrated ability to perform quantitative and qualitative analysis of assets using financial modeling techniques. Demonstrated ability to effectively define and resolve problems that balance multiple needs and interests.

-

Communication and trust: Excellent communication and people skills and an ability to work in a fast-paced, high-growth company. Proven ability to build strong working relationships with business partners and are seen as a trusted advisor.

-

Systems Savvy: Experience with NetSuite and EPM tools such as Planful, Adaptive, or Hyperion preferred; exposure to SQL and complex data frameworks a plus

-

Preferred working knowledge of real estate and/or hospitality investment analysis, financial modeling, valuation, and metrics, including but not limited to:

-

Financial modeling: capability of building complicated lending, equity/ownership, operating performance, GP/LP waterfall structures, sensitivity tables, and scenario analyses

-

Metrics: IRR, NPV, cash flow, ROI, levered/unlevered yield, cash-on-cash, yield-on-cost, NOI, cap rate, ADR, occupancy, etc.

Benefits

- $3,000 USD monthly compensation

- 100% remote - work from anywhere

About AvantStay

AvantStay Service

How does AvantStay work?

Company culture

Diversity

We're proud to be an equal opportunity employer -- and celebrate our employees' differences, including race, color, religion, sex, sexual orientation, gender identity, national origin, age, disability, and Veteran status.

Equity

We're proud to be an equal opportunity employer -- and celebrate our employees' differences, including race, color, religion, sex, sexual orientation, gender identity, national origin, age, disability, and Veteran status.

Unlock all Arc benefits!

- Browse remote jobs in one place

- Land interviews more quickly

- Get hands-on recruiter support